Did you know that the average homeowner could be overpaying for home insurance by as much as 37%? Understanding the true home insurance cost is crucial for protecting your biggest asset.

📌 Key Takeaways

- ✅ The average home insurance cost in the US is projected to be around $1,700 per year in 2026, but varies significantly by state.

- ✅ Factors like your home’s age, location, coverage limits, and deductible influence your homeowners insurance rates.

- ✅ Comparison shopping and bundling policies are effective strategies for finding cheap home insurance.

- ✅ Increasing your deductible and improving home security can help reduce your home insurance cost.

What Determines Your Home Insurance Cost in 2026?

The home insurance cost you pay is determined by a multitude of factors, all carefully weighed by insurance companies to assess the risk associated with insuring your property. Understanding these factors is the first step toward securing the best possible rate. According to data from the National Association of Insurance Commissioners (NAIC), the most significant elements impacting your homeowners insurance rates include your home’s location, its age and construction type, the coverage limits you choose, and your deductible amount.

Location plays a critical role because areas prone to natural disasters, such as hurricanes, tornadoes, or earthquakes, typically have higher premiums. Coastal states, for instance, often see elevated home insurance cost due to the increased risk of hurricane damage. Similarly, homes in areas with high crime rates might also face higher premiums.

The age and construction of your home are also significant. Older homes might have outdated electrical or plumbing systems, increasing the risk of fire or water damage. The type of materials used in your home’s construction also matters; for example, a brick home might be considered more resistant to fire than a wood-frame house.

Coverage limits refer to the maximum amount your insurance policy will pay out in the event of a claim. Higher coverage limits naturally lead to higher premiums. Finally, your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Opting for a higher deductible typically lowers your home insurance cost, but it also means you’ll have to pay more if you file a claim. It’s a balancing act between affordability and potential out-of-pocket expenses.

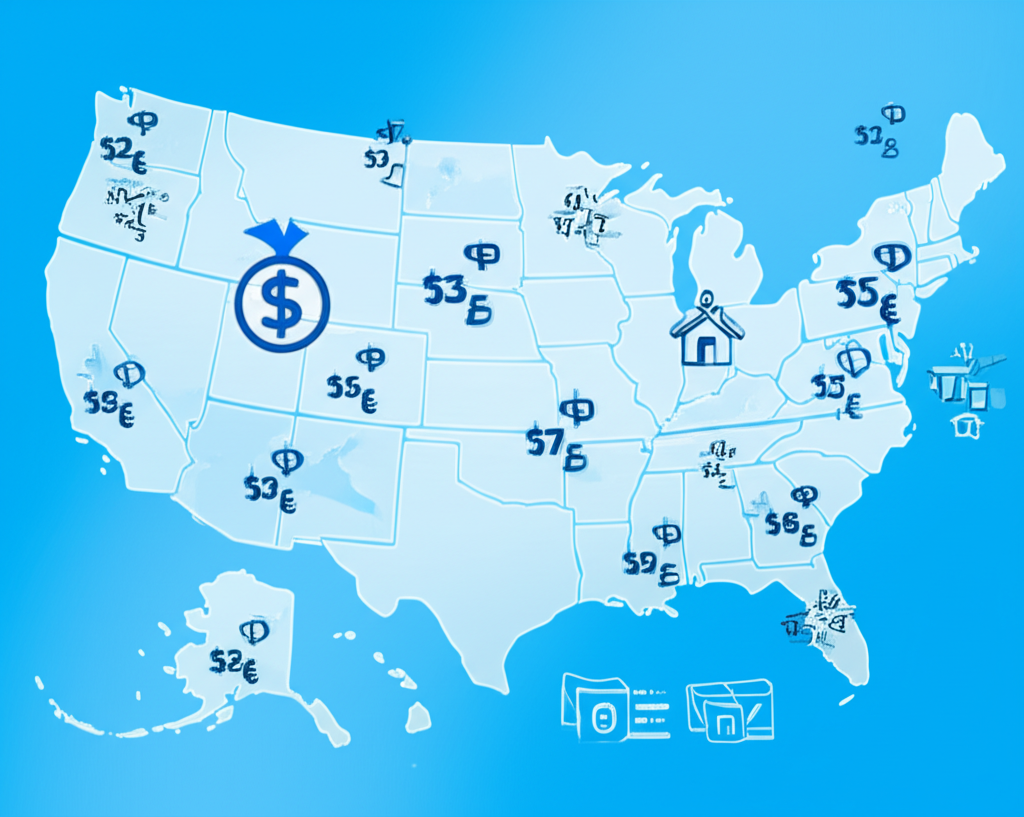

What is the Average Home Insurance Cost by State in 2026?

The average home insurance cost varies dramatically from state to state, influenced by factors like weather patterns, population density, and local building codes. Understanding the average home insurance cost by state 2026 allows you to benchmark your own rates and identify potential opportunities for savings.

Here’s a comparison table showing estimated average homeowners insurance rates across different states for 2026, based on projections and current trends:

| State | Average Annual Premium |

|---|---|

| Texas | $2,500 |

| Florida | $3,200 |

| Oklahoma | $2,300 |

| Louisiana | $2,900 |

| Mississippi | $2,400 |

| Kansas | $1,600 |

| Alabama | $1,900 |

| California | $1,200 |

| New York | $1,400 |

| Pennsylvania | $1,100 |

| Ohio | $1,000 |

| Michigan | $1,300 |

| Illinois | $1,500 |

| Georgia | $2,000 |

| North Carolina | $1,700 |

| South Carolina | $2,200 |

| Washington | $900 |

| Oregon | $850 |

| Arizona | $1,350 |

| Nevada | $1,150 |

These figures are estimates based on industry trends and projections for 2026 and assume coverage for a standard home with a $250,000 dwelling coverage limit.

As you can see, states like Florida and Texas, which are prone to hurricanes and other severe weather events, have significantly higher homeowners insurance rates compared to states like Oregon and Washington. This difference highlights the importance of considering your location when evaluating your home insurance cost.

How Can You Find Cheap Home Insurance in 2026?

Finding cheap home insurance requires a strategic approach that involves comparison shopping, exploring discounts, and optimizing your coverage. While the term “cheap” might suggest compromising on quality, the goal is to find the best value – comprehensive coverage at the most affordable price.

One of the most effective ways to lower your home insurance cost is to shop around and compare quotes from multiple insurers. Don’t settle for the first quote you receive; instead, get quotes from at least three to five different companies. Online comparison tools can streamline this process, allowing you to quickly see rates from various insurers side-by-side.

Another strategy is to bundle your home and auto insurance policies with the same company. Many insurers offer significant discounts – often ranging from 5% to 15% – for customers who bundle their policies. This can lead to substantial savings on your overall home insurance cost. Check out our guide on Best Auto Insurance Rates 2026 for more tips on saving on car insurance.

Increasing your deductible is another way to lower your premium. By agreeing to pay a higher amount out-of-pocket in the event of a claim, you can significantly reduce your homeowners insurance rates. However, make sure you can comfortably afford the higher deductible if you need to file a claim. Building an Emergency Fund Guide can help you prepare for this.

Finally, look for discounts. Many insurers offer discounts for things like having a security system, installing smoke detectors, or being a senior citizen. Don’t be afraid to ask your insurer about available discounts – you might be surprised at the savings you can unlock. You can also improve your credit score, as some insurers use credit information to determine premiums. Learn How to Raise Credit Score Fast for tips.

What Types of Home Insurance Coverage Are Available?

Understanding the different types of home insurance coverage is essential for ensuring you have adequate protection without overpaying. A standard home insurance policy typically includes several key components, each designed to protect you from specific types of losses.

Dwelling coverage protects the physical structure of your home, including the walls, roof, and foundation. This coverage is designed to cover the cost of repairing or rebuilding your home if it’s damaged by a covered peril, such as fire, wind, or hail.

Personal property coverage protects your belongings inside your home, such as furniture, clothing, and electronics. This coverage typically pays to replace your belongings if they are stolen or damaged by a covered peril. Some policies offer “replacement cost” coverage, which pays the full cost of replacing your belongings with new items, while others offer “actual cash value” coverage, which takes depreciation into account.

Liability coverage protects you if someone is injured on your property and you are found liable. This coverage can help pay for medical bills, legal fees, and other expenses. It’s important to have sufficient liability coverage to protect your assets in the event of a lawsuit.

Additional living expenses (ALE) coverage pays for your temporary housing and living expenses if you have to move out of your home due to a covered loss. This coverage can help pay for hotel bills, restaurant meals, and other expenses while your home is being repaired or rebuilt.

Understanding these different types of coverage will help you choose a policy that meets your needs and budget. Don’t just focus on finding the cheap home insurance; ensure you have adequate protection for your home and belongings.

How Can You Reduce Your Homeowners Insurance Premium?

There are several proactive steps you can take to reduce your homeowners insurance premium and save money on your annual home insurance cost. These strategies involve both short-term actions and long-term investments that can make your home safer and more insurable.

One of the most effective ways to lower your premium is to increase your deductible. By agreeing to pay a higher amount out-of-pocket in the event of a claim, you can significantly reduce your annual home insurance cost. However, make sure you can comfortably afford the higher deductible if you need to file a claim.

Another strategy is to improve your home’s security. Installing a security system, smoke detectors, and deadbolt locks can deter burglars and reduce the risk of fire, leading to lower premiums. Some insurers offer discounts for homes with these security features.

Regularly maintaining your home can also help prevent costly claims and keep your premiums down. This includes things like cleaning your gutters, trimming trees that are close to your home, and inspecting your roof for damage. Addressing potential problems before they escalate can save you money in the long run.

Consider making your home more disaster-resistant. For example, you could reinforce your roof to withstand high winds, install storm shutters, or elevate your home if you live in a flood-prone area. These improvements can not only protect your home from damage but also qualify you for discounts on your home insurance cost.

Finally, review your coverage annually. As your needs change, your insurance coverage should adapt as well. Make sure you’re not paying for coverage you don’t need and that you have adequate protection for your current situation. Comparison shopping each year can ensure you’re still getting the best possible rate.

How Does Home Insurance Comparison Affect Cost?

Engaging in home insurance comparison is not just a good practice; it’s a necessity for securing the most favorable home insurance cost and ensuring that you’re not overpaying for your coverage. The insurance market is dynamic, with rates fluctuating based on various factors, including the insurer’s risk assessment models, market competition, and recent claim history.

By comparing quotes from multiple insurers, you gain a comprehensive view of the market and can identify the companies offering the most competitive rates for your specific needs. This process allows you to see how different insurers weigh the various factors that influence your premium, such as your home’s location, age, construction type, and coverage limits.

Home insurance comparison also empowers you to negotiate with insurers. If you receive a lower quote from one company, you can use that information to negotiate a better rate with your current insurer or with another company you’re considering. Insurers are often willing to match or beat competitor’s rates to retain or attract customers.

Furthermore, comparing policies allows you to assess the coverage options and features offered by different insurers. Some policies might offer additional benefits, such as replacement cost coverage for personal property or higher limits for certain types of losses. By comparing these features, you can choose a policy that provides the best value for your money.

Remember, the home insurance cost is not the only factor to consider. You also want to ensure that the insurer has a good reputation for customer service and claims handling. Check online reviews and ratings to get a sense of the insurer’s reliability and responsiveness.

Expert Recommendation:

For homeowners on a tight budget, prioritizing a higher deductible and focusing on essential coverage is key to minimizing home insurance cost. Consider bundling your home and auto insurance for additional savings. My #1 pick for budget-conscious homeowners is Lemonade. They offer competitive rates and a user-friendly online experience, making it easy to manage your policy. However, remember to shop around and compare quotes to ensure you’re getting the best deal for your specific needs.

For homeowners focused on comprehensive coverage and peace of mind, regardless of budget, I recommend Chubb. While their premiums may be higher, they offer superior coverage and excellent customer service, providing a safety net for unexpected events.

For older homeowners, AARP through The Hartford often provides competitive rates and discounts tailored to their demographic.

Frequently Asked Questions

Q1. What happens if I don’t have home insurance?

If you don’t have home insurance and your home is damaged or destroyed, you’ll be responsible for covering the full cost of repairs or rebuilding. Additionally, if you have a mortgage, your lender will likely require you to maintain home insurance to protect their investment.

Q2. How much dwelling coverage do I need?

You should have enough dwelling coverage to cover the cost of rebuilding your home if it’s completely destroyed. Get a professional appraisal or consult with a contractor to estimate the cost of rebuilding your home based on current construction costs in your area.

Q3. Does home insurance cover flood damage?

Standard home insurance policies typically do not cover flood damage. If you live in a flood-prone area, you’ll need to purchase a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private insurer.

Q4. How often should I review my home insurance policy?

You should review your home insurance policy at least once a year, or whenever you make significant changes to your home or personal belongings. This will help ensure that you have adequate coverage and that your policy accurately reflects your current needs.

Q5. What is the difference between replacement cost and actual cash value?

Replacement cost coverage pays the full cost of replacing your belongings with new items, without deducting for depreciation. Actual cash value coverage takes depreciation into account, so you’ll receive less money for older items. Replacement cost coverage is generally more expensive but provides better protection. Consider Life Insurance Companies Compared for complete financial protection.

💬 Have questions about home insurance cost? Drop a comment below — we’ll analyze your situation for free! 📝 Found this helpful? Share it with someone who needs better financial advice! 👉 Related Reading: